Has Your Tax Bracket Changed in 2023?

The IRS has released the updated tax brackets, deductions and credits for the 2023 tax year. While tax filing for this year will not happen until early 2024, it is important to pay attention to your tax rate. Strategizing now can help minimize your tax liability and maximize your income potential.

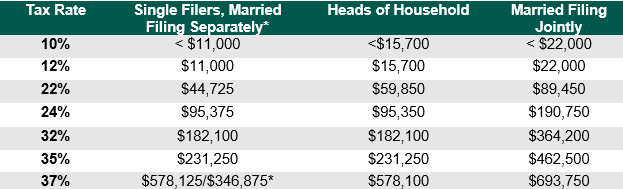

2023 Tax Brackets

The tax brackets for the 2023 tax year (filing in the spring of 2024) are as follows:

In addition to the tax brackets for 2023, taxpayers should be aware of these credits, deductions and phase-outs:

- The standard deduction for 2023 increases to $27,700 for married couples filing jointly, $13,850 for single filers and married filing separately and $20,800 for heads of household filers.

- Alternative minimum tax exemption is $81,300 for the tax year beginning January 1, 2023, and starts to phase out at $578,150. For married taxpayers filing jointly, those numbers are $126,500 and $1,156,300, respectively.

- The earned income tax credit amount for qualifying taxpayers with three or more qualifying children has been increased to $7,430.

- The monthly limitation for qualified transportation and qualified parking increases to $300.

- Flexible spending arrangements for health have a maximum contribution of $3,050, with $610 allowed to be carried over on qualified plans.

- Participants with self-only coverage in a Medical Savings Account will also see changes. The annual deductible must be between $2,650 and $3,950. The maximum out-of-pocket expense has increased to $5,300 for self-only coverage.

- The Medical Savings Account sets the annual deductible for family-covered qualified plans between $5,300 and $7,900. The out-of-pocket expense limit is $9,650.

- The Health Savings Account minimum annual deductible for self-only coverage is $1,500. The maximum out-of-pocket expense is $7,500.

- The Health Savings Account minimum annual deductible for family coverage is $3,000. The maximum out-of-pocket expense is $15,000.

- Foreign earned income exclusion is set at $120,000 for the 2023 tax year.

- The basic exclusion amount for estates of decedents who die in 2023 is increased to $12,920,000.

- The annual exclusion for gifts also increases this year, up to $17,000 for gifts received from January 1, 2023, to December 31, 2023.

- Qualified adoption expenses can be taken as a credit of up to $15,950 per child for the 2023 tax year.

To discuss how these updates may affect your unique tax situation or to create a tax plan for the year, please reach out to one of our tax professionals.